Managing payroll and tax reporting for drivers can be a challenging task for trucking companies. Ensuring compliance with IRS regulations, such as accurately preparing and filing 1099 forms, requires efficiency and precision. ACCUR8 TMS offers an innovative solution to streamline this preparation process, making it effortless to handle 1099-NEC forms for independent drivers through its user-friendly platform.

The Importance of Filing 1099-NEC Forms Electronically

The IRS requires companies to file Form 1099-NEC to report nonemployee compensation paid to independent contractors. If you have 10 or more forms to submit, electronic filing is mandatory. While it is possible to purchase paper forms and manually prepare them, this method is time-consuming and prone to errors. Electronic filing is not only more efficient but also reduces the likelihood of inaccuracies, saving time and money for your business.

ACCUR8 TMS: Streamlining 1099 Preparation

ACCUR8 TMS simplifies the payroll and tax reporting process by centralizing all data within a single, integrated system. Since payroll for drivers is already managed through the TMS, generating 1099-NEC forms becomes a hassle-free task. With just a few clicks, you can access the necessary data and prepare it for submission on electronic filing platforms like Tax1099.com. Here’s how:

- One-Click Reports:

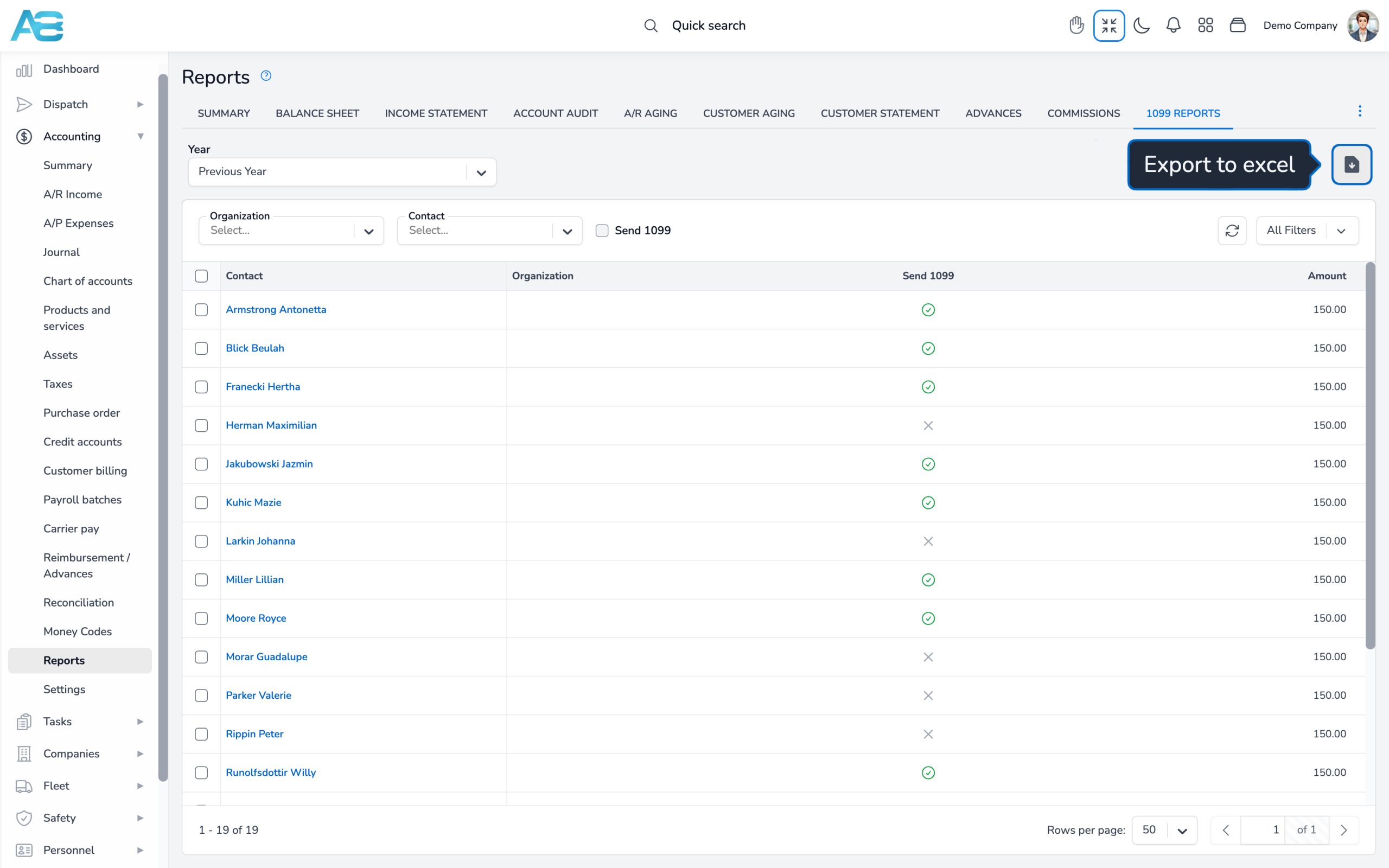

- Navigate to the “Accounting/Reports” section in ACCUR8 TMS.

- Select the “1099” option and generate a detailed Excel report containing all the required information for electronic filing. This eliminates the need for manual data entry and significantly reduces errors.

- Pre-Formatted Data for Compliance:

- The Excel report generated by ACCUR8 TMS is pre-formatted to meet IRS standards. It includes all necessary fields, such as the driver’s name, Taxpayer Identification Number (TIN), and the total compensation paid during the year.

- Facilitates Electronic Filing:

- The prepared data can be easily uploaded to electronic filing platforms like Tax1099.com, enabling seamless submission to the IRS.

Benefits of Using ACCUR8 TMS for 1099 Preparation

- Error Reduction:

- Manual preparation of 1099 forms can lead to mistakes, such as incorrect TINs or compensation amounts. ACCUR8 TMS minimizes these risks by pulling data directly from payroll records, ensuring accuracy.

- Cost Efficiency:

- Purchasing paper forms and manually filling them out requires additional time and resources. Using ACCUR8 TMS to prepare reports for electronic filing eliminates these costs while streamlining the entire process.

- Ease of Compliance:

- With electronic filing being mandatory for businesses with 10 or more forms, ACCUR8 TMS ensures compliance by providing all necessary tools to simplify data preparation.

- Scalability:

- Whether you’re managing a few drivers or a large fleet, ACCUR8 TMS scales effortlessly to accommodate your needs. The automated reporting feature can handle data for hundreds of drivers with the same level of efficiency.

Why Choose Electronic Filing?

Beyond being a requirement for businesses filing 10 or more 1099 forms, electronic filing offers numerous advantages:

- Faster Submission: Files are transmitted instantly to the IRS.

- Confirmation of Receipt: Receive immediate acknowledgment from the IRS, ensuring your forms were successfully submitted.

- Eco-Friendly: Reduces paper waste associated with manual filing.

Simplify Your Workflow with ACCUR8 TMS

Preparing 1099 forms manually can quickly become a logistical nightmare, especially as your fleet grows. ACCUR8 TMS’s integrated payroll and reporting tools eliminate the complexity, enabling you to focus on other aspects of your business. By using ACCUR8 TMS, you can:

- Access all payroll and tax data in one place.

- Generate compliant reports with a single click.

- Effortlessly upload prepared data to electronic filing platforms like Tax1099.com.

Conclusion

ACCUR8 TMS takes the guesswork out of 1099 preparation. Its streamlined, automated process ensures compliance with IRS regulations, reduces errors, and saves time. With the ability to generate pre-formatted reports for electronic filing, trucking companies can focus on what they do best—keeping their operations running smoothly.

Make tax season stress-free and efficient by leveraging the power of ACCUR8 TMS. Simplify your 1099 preparation today and experience the ease of modern fleet management.